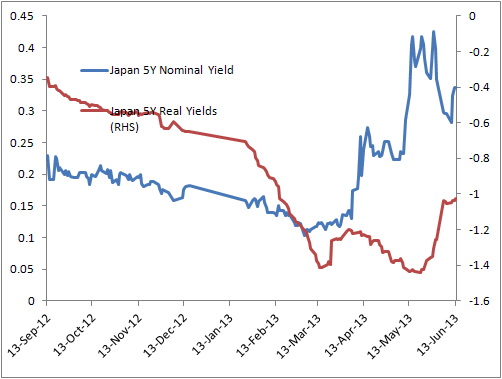

The US real yield sold off with the treasury. In Japan on the other hand, the real yields was actually rallied during the BoJ selloffs, and then sold off back in as the JGBs rallied back

The QE in Japan is perhaps a good measure, but at 200% debt-to-gdp it is if not too little, definitely late... and perhaps too late.

BoJ and Jap government can either cool down the stimulus and reform, and the expectation goes back to the previous level of "nothing really can work for Japan"

Or they can go all in.

If they do go all in, a tail scenario of hyper inflation is not far fetched. On a long term basis Japan high strikes payers can turn out to be a tremendous trade

And if they choose not to go all in, some future governer of BoJ and future PM of Japan will not have the luxary of the choice

The QE in Japan is perhaps a good measure, but at 200% debt-to-gdp it is if not too little, definitely late... and perhaps too late.

BoJ and Jap government can either cool down the stimulus and reform, and the expectation goes back to the previous level of "nothing really can work for Japan"

Or they can go all in.

If they do go all in, a tail scenario of hyper inflation is not far fetched. On a long term basis Japan high strikes payers can turn out to be a tremendous trade

And if they choose not to go all in, some future governer of BoJ and future PM of Japan will not have the luxary of the choice

No comments:

Post a Comment